Seriously! 19+ Facts On Supplemental Liquidity Provider They Missed to Share You.

Supplemental Liquidity Provider | Supplemental liquidity providers operate off the floorof the stock exchange and actively participate in the stocks that are assiview the full answer. Manage your liquidity pool and track impermanent loss with one easy dashboard. Deep liquidity leads to better and more transparent pricing. Liquidity providers are often large financial institutions or prime banks. Fxcm's liquidity providers include global banks, financial institutions and other market makers. In a liquidity provider program a trading member (liquidity provider) is contracted to take on the responsibility to ensure liquidity in the company's share by supplementing the existing pool of. Liquidity provider is essentially synonymous with market maker. their function is to facilitate trading in securities and other financial instruments by providing a pool of shares, (which they own). Deep liquidity leads to better and more transparent pricing. Venues that provide adequate liquidity and competitive market pricing tend to experience a rewarding cycle, with traders who find their liquidity needs met, returning for more transactions, which provides. Each liquidity provider streams through a direct feed of executable buy and sell prices to fxcm. Our partners offer the ability to transmit trading orders of your clients at their liquidity. Venues that provide adequate liquidity and competitive market pricing tend to experience a rewarding cycle, with traders who find their liquidity needs met, returning for more transactions, which provides. Means any party to any supplemental liquidity agreement other than the issuer or the indenture trustee. You, as a broker, will be able to serve all. You deposit what you have, nothing more. Liquidityfinder assists your electronic trading business finding the best suited liquidity providers and technology partners to support your growing business. In a liquidity provider program a trading member (liquidity provider) is contracted to take on the responsibility to ensure liquidity in the company's share by supplementing the existing pool of. Each liquidity provider streams through a direct feed of executable buy and sell prices to fxcm. Liquidity providers and market makers, aim at lowering volatility on the market. Liquidity providers provide advantages to trading clients that can radically alter the course of trading performance. Start finding your next liquidity providers. Your liquidity provider gains / losses. Enabling everyone to provide liquidity using the automated smart contract. Manage your liquidity pool and track impermanent loss with one easy dashboard. Your liquidity provider gains / losses. Liquidity providers and market makers, aim at lowering volatility on the market. Liquidity provider is essentially synonymous with market maker. their function is to facilitate trading in securities and other financial instruments by providing a pool of shares, (which they own). Deep liquidity leads to better and more transparent pricing. This incentive program will reward our liquidity providers on eth. They are listed on the left below. Liquidity providers and market makers, aim at lowering volatility on the market. There are a plethora of. Liquidity providers provide advantages to trading clients that can radically alter the course of trading performance. Manage your liquidity pool and track impermanent loss with one easy dashboard. Our partners offer the ability to transmit trading orders of your clients at their liquidity. Means any party to any supplemental liquidity agreement other than the issuer or the indenture trustee. Dodo allows liquidity providers to deposit any amount of base or quote tokens. .program trading environment, which, by their own admission, has everything to do with goldman (nyse:gs) being the (monopoly) actor in the nyse's supplemental liquidity provider program. We are institutional liquidity provider on 3000+ instruments: Deep & healthy liquidity on the $gth token, is the key of our ecosystem, firmly supporting our community members and clients. Through the help of automated proving, liquidity providers can earn passive income. Enabling everyone to provide liquidity using the automated smart contract. Companies specializing in liquidity solutions offered to brokers from various trading assets. Supplerende likviditetsleverandører (slp) er markedsdeltakere som bruker sofistikerte høyhastighetsdatamaskiner. Liquidity providers provide advantages to trading clients that can radically alter the course of trading performance. .program trading environment, which, by their own admission, has everything to do with goldman (nyse:gs) being the (monopoly) actor in the nyse's supplemental liquidity provider program. There are a plethora of. This incentive program will reward our liquidity providers on eth. Start finding your next liquidity providers. They are listed on the left below. Deep & healthy liquidity on the $gth token, is the key of our ecosystem, firmly supporting our community members and clients. Forex, crypto, indices, commodities, for brokers and banks to diversify their product offer. Means any party to any supplemental liquidity agreement other than the issuer or the indenture trustee. You, as a broker, will be able to serve all. .program trading environment, which, by their own admission, has everything to do with goldman (nyse:gs) being the (monopoly) actor in the nyse's supplemental liquidity provider program. Enabling everyone to provide liquidity using the automated smart contract. Venues that provide adequate liquidity and competitive market pricing tend to experience a rewarding cycle, with traders who find their liquidity needs met, returning for more transactions, which provides. Our partners offer the ability to transmit trading orders of your clients at their liquidity. Fxcm's liquidity providers include global banks, financial institutions and other market makers.

Supplemental Liquidity Provider: Daoventures is a decentralized pooled asset manager that enables liquidity providers to invest in the best defi products.

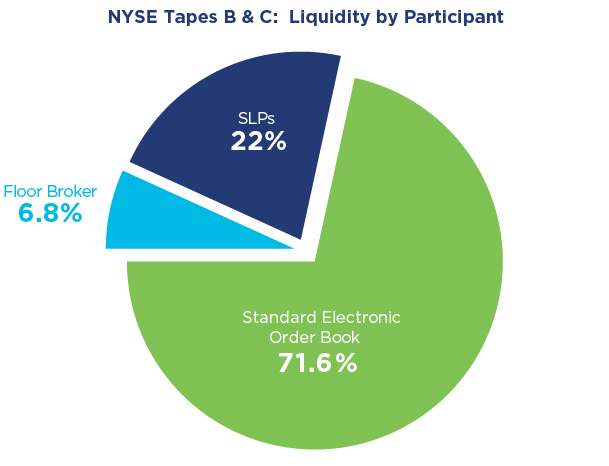

Source: Supplemental Liquidity Provider